FSB releases recommendations to regulate 'Global Stablecoins'

The Financial Stability Board (FSB) published its G20 recommendations on Global Stablecoins (GSCs), suggesting new standards for global regulations are to be set by mid-2022

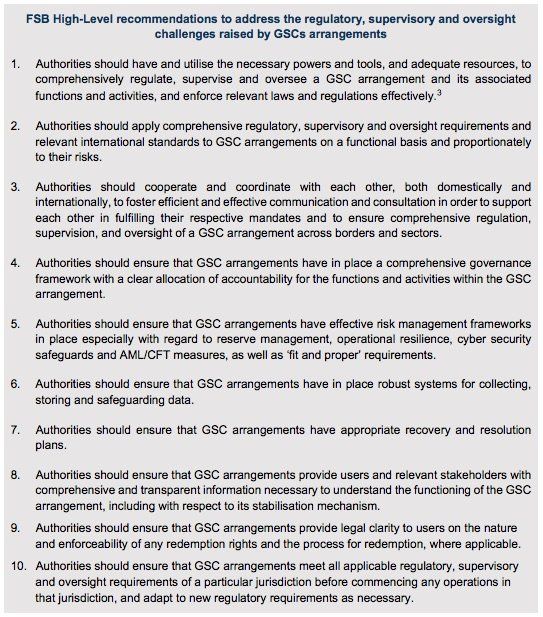

The Financial Stability Board (FSB) has published the final version of its high-level recommendations for the regulation, supervision and oversight of “global stablecoin” (GSC) arrangements.

The report comes just days after the BIS partnered with several central banks to release a report on the principles and core features of CBDCs (Central Bank Digital Currencies) that other central banks globally must adhere to.

The report states that GSC arrangements are expected to adhere to all applicable regulatory standards and to address risks to financial stability before commencing operation, and to adapt to new regulatory requirements as necessary.

Some of the recommendations also stress the value of flexible, efficient, inclusive, and multi-sectoral cross-border cooperation, coordination, and information sharing arrangements among authorities.

- Completion of international standard-setting work by December 2021.

- Establishment or, as necessary, adjustment of cooperation arrangements among authorities by December 2021 (and as needed based on market evolution).

- At a national level, establishment or, as necessary, adjustment of regulatory, supervisory and oversight frameworks consistent with the FSB recommendations and international standards and guidance by July 2022 (and as needed based on market evolution).

- Review of implementation and assessment of the need to refine or adapt international standards by July 2023.

Some of the recommendations on the 73-page report included the need for clear allocation of accountability, the importance of risk management frameworks in regards to AML/CFT and cybersecurity safeguards, the need for robust data collection and storage systems, recovery and resolution plans and legal clarity regarding redemption rights for the users.

The report is intended to primarily address risks to financial stability and therefore does not cover important issues such as money laundering or terrorist financing, data privacy, cyber security consumer and investor protection and competition, which however could have consequences for financial stability if they are not properly addressed. It therefore stresses the importance of addressing these issues as part of a comprehensive effective supervisory, regulatory and oversight framework.

Regulators for bank capital and anti-money laundering will report by December 2021 on whether rule changes are needed. The FSB added that a review of how stablecoins are being regulated will be completed by July 2023.

Source:

Regulation, Supervision and Oversight of “Global Stablecoin” Arrangements Final Report and High-Level Recommendations

https://www.fsb.org/wp-content/uploads/P131020-3.pdf

Disclaimer:

GlobalStablecoins.com is an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. Don’t take it as investment advice. Speak to an advisor before you risk investing in an ICO, Cryptocurrencies, Cryptoassets, Security Tokens, Utility Tokens, Exchange Tokens, Global Stablecoins, Stablecoins or eMoney Tokens. GlobalStablecoins.com is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

Affiliate Disclosure / Sponsored Posts:

If a Sponsored Post contains any mention of a crypto project, we encourage our readers to conduct diligence prior to taking further action. GlobalStablecoins.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

GlobalStablecoins.com may receive compensation for affiliate links. Should you perform activities in relation to an affiliate link, it is understood that some form of compensation might be made to GlobalStablecoins.com. For example, if you click on an affiliate link, and sign up and trade on an exchange, GlobalStablecoins.com may receive compensation.

Before you invest in Cryptoassets you should be aware of the following,

Cryptoassets are considered very high risk, speculative investments.

If you invest in Cryptoassets you should be prepared to lose all your money.

All Sponsored Posts are paid for by crypto projects, coin foundations, advertising firms, PR firms, or other marketing agencies. GlobalStablecoins.com is not a subsidiary of any marketing agency, nor are we owned by any crypto or blockchain foundation.

The purpose of offering Sponsored Posts to our advertisers is to help fund the day-to-day business operations at GlobalStablecoins.com.

If you come across a Sponsored Post which you believe is fraudulent and/or “scammy,” please contact us and we will perform an immediate investigation.

All Rights Reserved | GlobalStablecoins.com