House Financial Service Committee launch the first CBDC Principles

Republicans on The House Financial Service Committee launch the first “CBDC Principles” indicating the US will get Global Stablecoins long before a CBDC

Today, the Republicans on the House Financial Services Committee, led by Ranking member Patrick McHenry have released their “principles” aiming at guiding Congress in its review of a digital dollar.

The document demonstrates that they are of the opinion that the public sector should lead the way and is going out of its way to ensure that Stablecoins will become part of the payment mix.

This is a significant moment for the likes of Circle's USDC and Meta’s Diem coin, who have been paving the way for Stablecoins and their users who wish to benefit from secure, inclusive, free and immediate payment a reality in the US and beyond.

The principles were developed by Committee Republicans’ Digital Asset Working Group

To quote the Working Group Members:

“This is a pivotal moment in the conversation around the growing role of financial technology in our everyday lives. As we consider how issuing a U.S. Central Bank Digital Currency may fit into this 21st-century landscape, it is critical that lawmakers fully understand both the potential costs and benefits. That is why Financial Services Committee Republicans have crafted principles to ensure the discussion is focused on whether a Fed-issued digital currency addresses a problem, rather than creating one.

First and foremost, the U.S. dollar and payment system must remain the best in the world. To accomplish this goal, we must not stifle private sector innovation and competition. The ball is in Congress’ court—as the Federal Reserve cannot issue a digital currency without Congressional authority—and Republicans will continue to fully assess how a Fed-issued digital currency could impact our nation’s competitiveness and our financial system.”

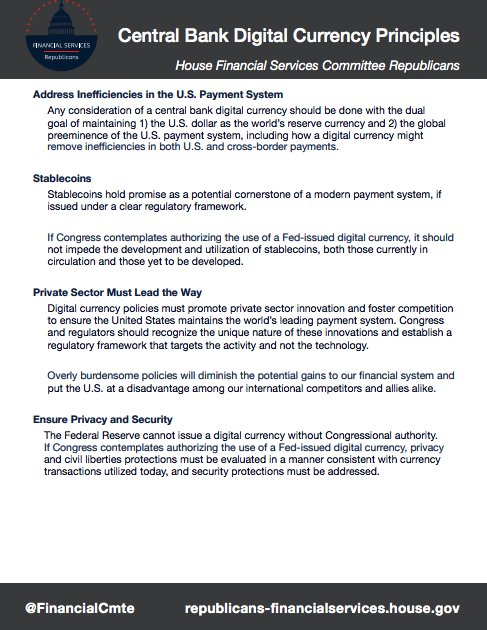

The CBDC Principles :

Address Inefficiencies in the U.S. Payment System

Any consideration of a central bank digital currency should be done with the dual goal of maintaining 1) the U.S. dollar as the world’s reserve currency and 2) the global preeminence of the U.S. payment system, including how a digital currency might remove inefficiencies in both U.S. and cross-border payments.

Stablecoins

Stablecoins hold promise as a potential cornerstone of a modern payment system, if issued under a clear regulatory framework.

If Congress contemplates authorising the use of a Fed-issued digital currency, it should not impede the development and utilisation of stablecoins, both those currently in circulation and those yet to be developed.

Private Sector Must Lead the Way

Digital currency policies must promote private sector innovation and foster competition to ensure the United States maintains the world’s leading payment system. Congress and regulators should recognise the unique nature of these innovations and establish a regulatory framework that targets the activity and not the technology.

Overly burdensome policies will diminish the potential gains to our financial system and put the U.S. at a disadvantage among our international competitors and allies alike.

Ensure Privacy and Security

The Federal Reserve cannot issue a digital currency without Congressional authority. If Congress contemplates authorising the use of a Fed-issued digital currency, privacy and civil liberties protections must be evaluated in a manner consistent with currency transactions utilised today, and security protections must be addressed.

Recent comments by federal regulators appear to indicate that stablecoins must be more tightly regulated with some being deemed to be securities. While Congressional legislation may be the next logical step, in all likelihood a CBDC/Stablecoin bill may take some time leaving regulators to act on their own in a policy vacuum.

These principles were developed by Committee Republicans’ Digital Asset Working Group Members including Rep. Ann Wagner (MO-02), Rep. Blaine Luetkemeyer (MO-03), Rep. Bill Huizenga (MI-02), Rep. Andy Barr (KY-06), Rep. French Hill (AR-02), Rep. Tom Emmer (MN-06), Rep. Warren Davidson (OH-08), Rep. Ted Budd (NC-13), and Rep. Anthony Gonzalez (OH-16).

https://republicans-financialservices.house.gov/uploadedfiles/cbdc_principles_one_pager.pdf

Disclaimer:

GlobalStablecoins.com is an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. Don’t take it as investment advice. Speak to an advisor before you risk investing in an ICO, Cryptocurrencies, Cryptoassets, Security Tokens, Utility Tokens, Exchange Tokens, Global Stablecoins, Stablecoins or eMoney Tokens. GlobalStablecoins.com is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

Affiliate Disclosure / Sponsored Posts:

If a Sponsored Post contains any mention of a crypto project, we encourage our readers to conduct diligence prior to taking further action. GlobalStablecoins.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

GlobalStablecoins.com may receive compensation for affiliate links. Should you perform activities in relation to an affiliate link, it is understood that some form of compensation might be made to GlobalStablecoins.com. For example, if you click on an affiliate link, and sign up and trade on an exchange, GlobalStablecoins.com may receive compensation.

Before you invest in Cryptoassets you should be aware of the following,

Cryptoassets are considered very high risk, speculative investments.

If you invest in Cryptoassets you should be prepared to lose all your money.

All Sponsored Posts are paid for by crypto projects, coin foundations, advertising firms, PR firms, or other marketing agencies. GlobalStablecoins.com is not a subsidiary of any marketing agency, nor are we owned by any crypto or blockchain foundation.

The purpose of offering Sponsored Posts to our advertisers is to help fund the day-to-day business operations at GlobalStablecoins.com.

If you come across a Sponsored Post which you believe is fraudulent and/or “scammy,” please contact us and we will perform an immediate investigation.

All Rights Reserved | GlobalStablecoins.com