Blog Layout

Enhanced Cross-Border Payments Critical for Global Economic Growth, Trade And Financial Inclusion

PAR002_123 • Jul 14, 2020

The Financial Stability Board (FSB) today published a letter to the G20 welcoming the report published today by the BIS's Committee on Payments and Market Infrastructures (CPMI)

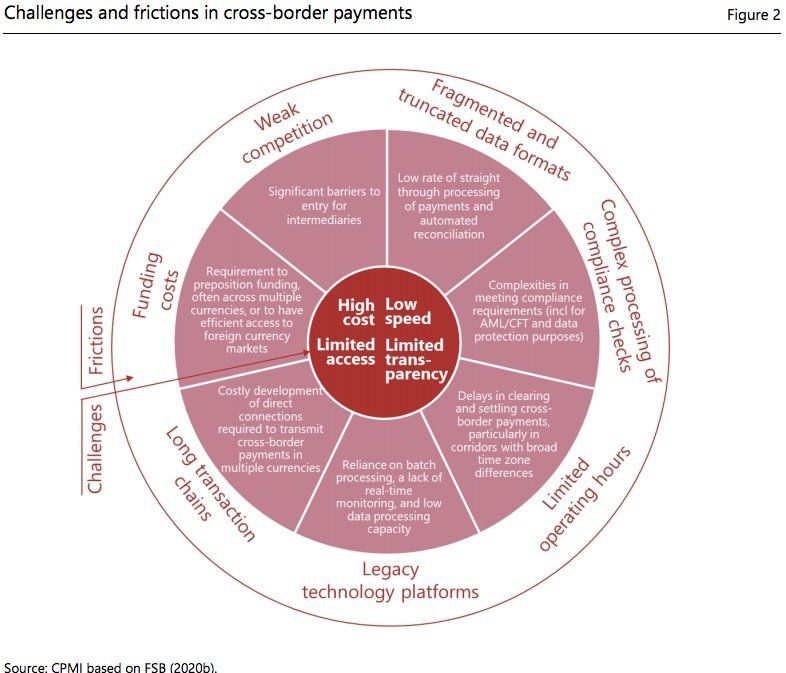

According to the CPMI, the international standard setter which promotes the safety and efficiency of payment, clearing, settlement and related arrangements, “Faster, cheaper, more transparent and more inclusive cross-border payment services would deliver widespread benefits for citizens and economies worldwide, supporting economic growth, international trade, global development and financial inclusion.”

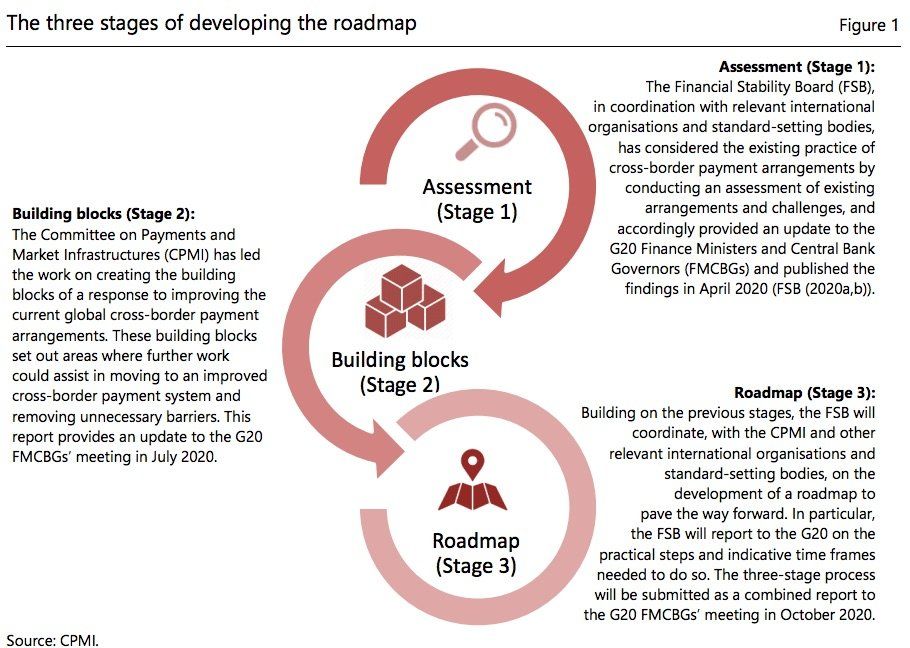

Assessment (Stage 1): In its April report the FSB, in coordination with relevant international organisations and standard-setting bodies assessed existing arrangements and challenges

Building Blocks (Stage 2): The Committee on Payments and Market Infrastructures (CPMI) led the work on creating building blocks of a response to improve the current global cross-border payment arrangements. The report sets out areas where further public sector work could assist in moving to an improved cross-border payments system and in public goods or removing unnecessary barriers.

Roadmap (Stage 3): Building on the previous stages, the FSB will coordinate, with CPMI and other relevant international organisations and standard-setting bodies, the development of a roadmap to pave the way forward. In particular, the FSB will report to the G20 on practical steps and indicative timeframes needed to do so. The three-stage process will be submitted as a combined report to the G20 in October 2020.

This letter from the FSB

to the G20, accompanied the BIS's CPMI report “Enhancing cross-border payments: building blocks of a global roadmap,” setting out building blocks for a roadmap to enhance cross-border payments.

Three Stages of Developing The Road Map

The publication of the CPMI report marks the second of a three-stage process, coordinated by the FSB at the request of the G20, to develop a roadmap to enhance cross-border payments. The report was delivered to G20 Finance Ministers and Central Bank Governors ahead of their virtual meeting on 18 July.

19 Building Blocks

Each of those nineteen building blocks assessed in this report was determined to have the potential to address at least one of the seven frictions identified in the first report published by the Financial Stability Board earlier this year. The task force working on the blocks assessed undertook a qualitative analysis for each building block.

The task force looked at a block’s:

- Expected impact on the seven frictions.

- Its interdependencies with other building blocks.

- The complexity and potential time frame of its delivery.

- The potential risks that advancing a building block could create for the smooth functioning of payment systems, monetary stability and financial stability.

Overview of Focus Areas

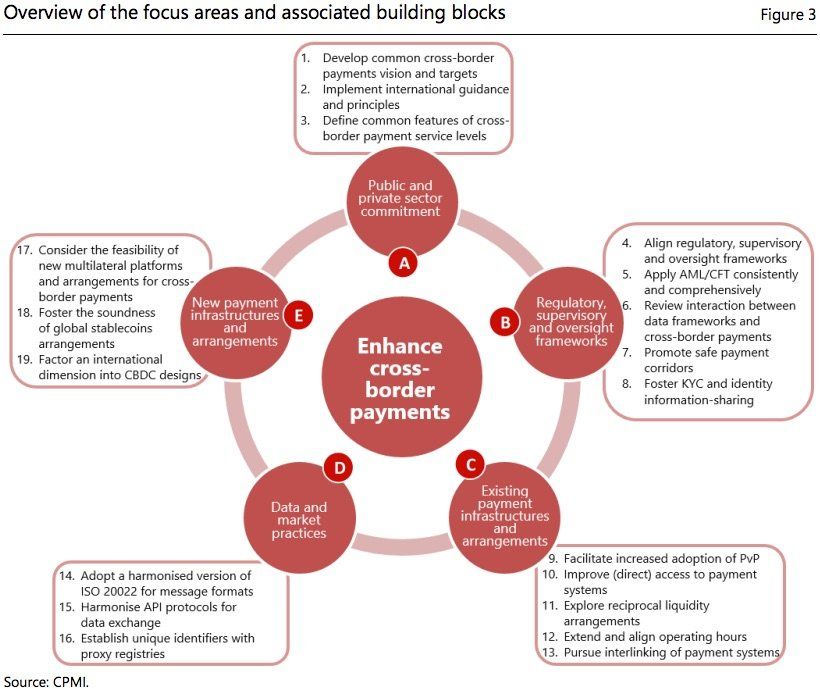

The 19 building blocks are arranged into five focus areas, four of which (focus areas A to D) seek to enhance the existing payments ecosystem, while focus area E is more exploratory and covers emerging payment infrastructures and arrangements (Figure 3). Work on some of the building blocks is already under way in a number of jurisdictions, while with others it will take more time to assess implementation.

- Focus area A: Commit to a joint public and private sector vision to enhance cross-border payments.

- Focus area B: Coordinate on regulatory, supervisory and oversight frameworks.

- Focus area C: Improve existing payment infrastructures and arrangements to support the requirements of the cross-border payments market.

- Focus area D: Increase data quality and straight through processing by enhancing data and market practices.

- Focus area E: Explore the potential role of new payment infrastructures and arrangements.

The BIS’ suggests “fostering the soundness of global stablecoin arrangements” which could be good news for companies like Facebook, which is hoping to launch its Libra project late 2020 early 2021.

The BIS said that “much will depend on the design features of global stablecoins, which at the time of writing of this report are not yet clear.”

The BIS offered a number of solutions it stated could help the cause of global stablecoins, including:

• Designing and implementing global stablecoin arrangements in line with international standards and domestic regulations and policies.

• Implementing internationally coordinated regulatory, supervisory and oversight approaches to global stablecoin arrangements.

• Clarification of legal treatment in a cross-jurisdictional context in all jurisdictions.

Supervisors and regulators will have to work in a coordinated manner to make sure that "rulemaking can facilitate and benefit from technical and operational change delivered within the payments market without compromising sovereignty.”

The report was delivered to G20 Finance Ministers and Central Bank Governors ahead of their virtual meeting on 18 July.

07 Mar, 2024

In response to the increasing prominence of global stablecoins (GSCs) and their potential implications for financial stability, the Bank for International Settlements (BIS) has introduced a comprehensive set of recommendations aimed at regulating and supervising these widely adopted digital assets.

29 Jul, 2023

In a noteworthy development within the U.S. Congress, a long-awaited stablecoin bill made significant progress as it graduated from the House Financial Services Committee. However, the advancement of the Republican-backed bill was marred by a partisan clash and objections from the White House, leaving the committee chair, Patrick McHenry (R-N.C.), lamenting the missed opportunity for a bipartisan deal.

13 Jul, 2023

A new crypto oversight bill reintroduced by Senators Cynthia Lummis and Kirsten Gillibrand is making waves in the U.S. Senate. The bill proposes that crypto exchanges be overseen by the Commodity Futures Trading Commission (CFTC) rather than the U.S. Securities and Exchange Commission (SEC). Additionally, it calls for all stablecoin issuers to be regulated depository institutions. This bill represents a significant effort to establish U.S. regulation for the crypto industry and addresses the division of oversight between the SEC and CFTC.

13 Jul, 2023

In preparation for the upcoming G20 Finance Ministers and Central Bank Governors meeting in India, Klaas Knot, Chair of the Financial Stability Board (FSB), has highlighted the recent banking turmoil and the FSB's commitment to learning valuable lessons from these events. In a letter addressed to the G20 officials, Knot emphasized the importance of addressing risks associated with crypto-assets and global stablecoin arrangements, as well as providing updates on efforts to tackle climate-related financial risks.

12 Jul, 2023

E-Money Token (Stablecoin) issuers have been advised to proactively prepare for the forthcoming regulations set by the European Union, according to the European Banking Authority (EBA). Although the rules of the Markets in Crypto Assets (MiCA) framework will officially come into effect in June 2024, the EBA emphasised the importance of early preparation to protect consumers and avoid disruptions for companies. The MiCA regulation includes provisions on governance, reserve requirements, and licensing for crypto wallet providers and exchanges.

12 Jul, 2023

According to a recent study by Juniper Research, the value of payment transactions made with stablecoins is predicted to surpass $187 billion by 2028, a significant increase from $53 billion in 2023. The study, titled "CBDCS & STABLECOINS: KEY OPPORTUNITIES, REGIONAL ANALYSIS & MARKET FORECASTS 2023-2030," highlights the rapid progress of stablecoins in the cross-border market, where they offer an alternative to slow, expensive, and difficult-to-track existing payment systems.

12 Jul, 2023

Reserve Bank of India (RBI) Deputy Governor T Rabi Sankar expressed India's concerns about stablecoins, emphasising their potential threat to policy sovereignty. In a speech at a banking event, Sankar called for a global financial system based on central bank digital currencies (CBDCs) issued by each country for settling global payments. He highlighted the importance of CBDCs in maintaining financial stability and independence, stating, "We should ideally aim for a global financial system which rests on central bank digital currencies (CBDCs) issued by each country to settle global payments, and not rely on stablecoins."

11 Jul, 2023

In a speech delivered on July 10, Bank of England (BOE) Governor Andrew Bailey shared his perspective on digital currencies, highlighting the potential of "enhanced digital money" while expressing reservations about cryptocurrencies and stablecoins. Bailey emphasised the need for regulatory oversight, stability, and usability in the evolving financial landscape.

06 Jul, 2023

In a move that could reshape the global stablecoin market, Hong Kong is considering the launch of its own stablecoin, HKDG, to rival established stablecoins such as USDT and USDC. This groundbreaking proposal, co-authored by prominent figures in academia and industry, including Vice Chancellor Wang Yang and angel investor Cai Wensheng, aims to enhance Hong Kong's position in the digital currency landscape and assert its leadership in the blockchain sector.

30 Jun, 2023

Canadian lawmakers have published a groundbreaking report that defends and supports the crypto industry, calling for the recognition of blockchain as a growing sector with the potential to drive job creation and economic growth. The report, which includes 16 recommendations, has garnered praise from industry participants, including leading cryptocurrency exchange Coinbase.

Disclaimer:

GlobalStablecoins.com is an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. Don’t take it as investment advice. Speak to an advisor before you risk investing in an ICO, Cryptocurrencies, Cryptoassets, Security Tokens, Utility Tokens, Exchange Tokens, Global Stablecoins, Stablecoins or eMoney Tokens. GlobalStablecoins.com is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

Affiliate Disclosure / Sponsored Posts:

If a Sponsored Post contains any mention of a crypto project, we encourage our readers to conduct diligence prior to taking further action. GlobalStablecoins.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

GlobalStablecoins.com may receive compensation for affiliate links. Should you perform activities in relation to an affiliate link, it is understood that some form of compensation might be made to GlobalStablecoins.com. For example, if you click on an affiliate link, and sign up and trade on an exchange, GlobalStablecoins.com may receive compensation.

Before you invest in Cryptoassets you should be aware of the following,

Cryptoassets are considered very high risk, speculative investments.

If you invest in Cryptoassets you should be prepared to lose all your money.

All Sponsored Posts are paid for by crypto projects, coin foundations, advertising firms, PR firms, or other marketing agencies. GlobalStablecoins.com is not a subsidiary of any marketing agency, nor are we owned by any crypto or blockchain foundation.

The purpose of offering Sponsored Posts to our advertisers is to help fund the day-to-day business operations at GlobalStablecoins.com.

If you come across a Sponsored Post which you believe is fraudulent and/or “scammy,” please contact us and we will perform an immediate investigation.

© 2024

All Rights Reserved | GlobalStablecoins.com