SEC Chair Warns That Action May Be Taken against Stablecoins

Sponsored Post

Securities and Exchange Commission (SEC) Chair Gary Gensler said cryptocurrencies whose prices depend on more traditional securities might fall under securities laws.

“Make no mistake: It doesn’t matter whether it’s a stock token, a stable value token backed by securities, or any other virtual product that provides synthetic exposure to underlying securities,”

“These platforms whether in the decentralised or centralised finance space are implicated by the securities laws and must work within our securities regime.”

The SEC Chair's speech followed separate comments from the U.S. Treasury Secretary Janet Yellen after meeting with the President’s Working Group on Financial Markets (PWG) and the Federal Reserve Chair Jerome Powell's testimony before the U.S. Senate Banking Committee, who compared stablecoins to bank deposits and money market mutual funds, two products that are heavily regulated to provide consumer protection and protect the stability of the financial system. Federal Reserve Chair Jerome Powell was asked about central bank digital currencies (CBDC) and stablecoins. He said he was undecided about a central bank digital dollar and believes stablecoins need regulation.

Powell said,

“If they’re going to be a significant part of the payments universe, then we need an appropriate regulatory framework which, frankly, we don’t have.”

The Treasury Department said,

“The secretary underscored the need to act quickly to ensure there is an appropriate U.S. regulatory framework in place,”

Last year, the PWG which includes the US Treasury, the Federal Reserve, the SEC and the CFTC, published a document outlining initial regulatory issues regarding stablecoins. That paper had in its sights the likes of Diem (formerly Libra), the stablecoin initiative founded by Facebook. But even without Diem the top three stablecoins Tether, USDC and Binance USD have a total market capitalisation of $100 billion.

So while the current focus may be the quality of the backing assets, the other issue is “same business, same risk, same rules” as mentioned in the 2020 President’s Working Group paper.

That document also stated, “a stablecoin may constitute a security, commodity, or derivative subject to the U.S. federal securities, commodity, and/or derivatives laws.”

This contrasts with laws elsewhere, such as Europe, where draft legislation plans to govern fiat-backed stablecoins such as the 100% Collateralised e-Money Stablecoins (eEUR, eCHF, eSEK, eNOK & eDKK) by putting the issuer firmly under the oversight of central banks.

Circle USDC

Circle, the issuer of USDC, published a breakdown of the assets backing the stablecoin. In addition to cash, the token is backed by money market funds, commercial paper, corporate and municipal bonds and certificates of deposits issued by foreign banks.

In an attestation report by major accounting firm Grant Thornton, the company revealed the reserves backing USDC. A total of 22,176,182,251 USDC was in circulation at the time of the report, with the accounting giant confirming that the total fair value of Circle’s dollar-denominated assets was equal to the supply of USDC in circulation.

A breakdown of the reserves backing the stable coin showed that 61 percent of USDC reserves were held in case and cash reserves, which is equal to $13.4 billion. Also, 13 percent is held in Yankee Certificate of Deposits (CDs), a dollar-denominated savings vehicle issued by a foreign bank with a branch in the United States.

Furthermore, 12%, which totals $2.7 billion, is allocated to US Treasuries. Meanwhile, nine percent is held commercial paper, while the remaining five percent is allocated to Corporate Bonds.

In a blog post by Circle CEO Jeremy Allaire, the breakdown of USDC’s reserves is a way to ensure that every stable coin in circulation was equal to one dollar. Allaire also said that the Circle team was committed to being transparent, accountable, and trustworthy.

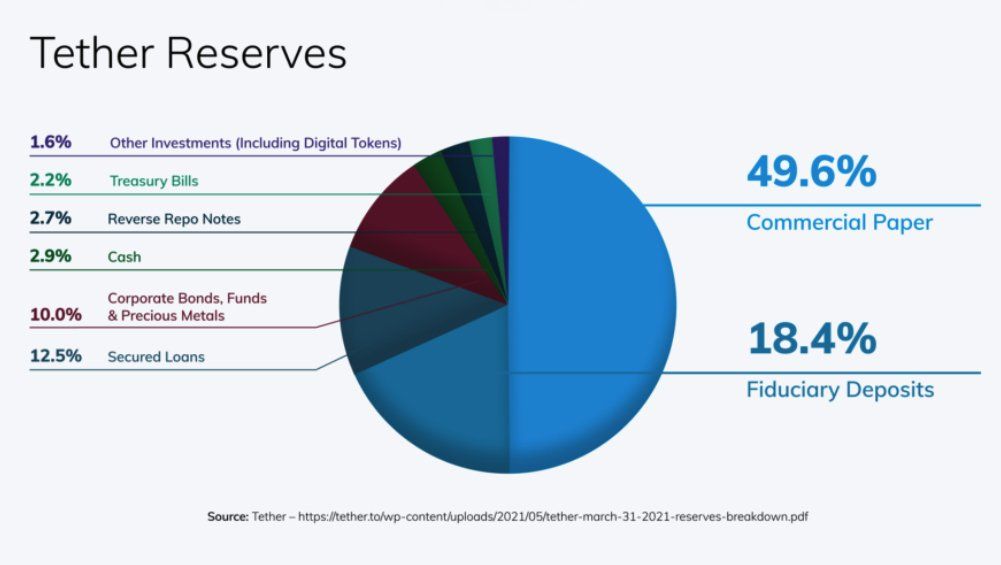

Tether (USDT)

A day after rival stablecoin issuer Circle released more data about the assets behind USDC, Tether executives went on CNBC’s online show Tech Check to answer questions about its own token, USDT.

An audit for Tether, issuer of the largest stablecoin USDT, could be “months away, not years,” the company’s Stuart Hoegner said in an CNBC interview on Wednesday.

Tether promised audits as far back as 2017, but has yet to produce one. The company even hired New York-based accountants Friedman LLP that year to produce reports, but the relationship was dissolved in early 2018. No audit has ever been issued, though Tether published an attested report in March, 2021. An audit is generally considered to be a far more intensive accounting procedure than an attestation.

Currently, Neither USDC nor Tether are regulated digital assets, for the simple reason that neither token has a regulator. If USDC or Tether adjusted their reserving practices so that their tokens were to actually become stablecoins (legitimately backed, 1:1, by Fiat Deposits in Banks), proper regulation must follow.

As the crypto industry generally and specifically stablecoins shifts from early adopter instruments to mainstream consumer payments for goods and services, comprehensive oversight of the products and services offered by those firms is the only way to protect clients and customers. This shift has the potential to change the lives of everyone in the world, particularly those without ready access to the financial system, which is still billions of people today. Transparency in operations is crucial and should be essential. Trustworthiness and regulation are instrumental to realising the enormous potential of stablecoins in the long-term.

Audited Stablecoins

As of today, there are few 100% Collateralised stablecoins in the world: Paxos Standard (“PAX”) e-Money ("eEUR, eCHF, eSEK, eNOK & eDKK") and Binance Dollar (“BUSD”) and the Gemini Dollar (“GUSD”).

The value of each stablecoin token is tied directly to the value of the same Fiat Currency, and the amount of “reserve” currency is equal or exceed the number of stablecoins outstanding.

Regular audits are

important because it assures stablecoin users that the Fiat Currency underlying their stablecoins are secure and will be immediately available when they want them. The NYDFS ensures the Trust companies and their individual tokens are following its strict rules at all times.

USDC and Tether are used frequently in the crypto economy and have a useful role to play, just as Bitcoin, Ethereum and other unregulated digital assets play an important role. Users who are willing to tolerate the risk of a token backed by only 61% cash or cash equivalents (in the case of USDC) or 5% (in the case of Tether) should be free to take that risk — subject of course to applicable securities laws. But these tokens are not 100% collateralised with Regularly Audited Fiat Bank Deposits, and the two should not be confused.

Disclaimer:

GlobalStablecoins.com is only an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. Don’t take it as investment advice. Speak to an advisor before you risk investing in an ICO, Cryptocurrencies, Cryptoassets, Security Tokens, Utility Tokens, Exchange Tokens, Global Stablecoins, Stablecoins or eMoney Tokens. GlobalStablecoins.com is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

Sponsored Posts:

If a Sponsored Post contains any mention of a crypto project, we encourage our readers to conduct diligence prior to taking further action. GlobalStablecoins.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

. Before you invest in Cryptoassets you should be aware of the following.

Cryptoassets are considered very high risk, speculative investments.

If you invest in Cryptoassets you should be prepared to lose all your money.

All Sponsored Posts are paid for by crypto projects, coin foundations, advertising firms, PR firms, or other marketing agencies. GlobalStablecoins.com is not a subsidiary of any marketing agency, nor are we owned by any crypto or blockchain foundation.

The purpose of offering Sponsored Posts to our advertisers is to help fund the day-to-day business operations at GlobalStablecoins.com.

If you come across a Sponsored Post which you believe is fraudulent and/or “scammy,” please contact us and we will perform an immediate investigation.

Disclaimer:

GlobalStablecoins.com is an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. Don’t take it as investment advice. Speak to an advisor before you risk investing in an ICO, Cryptocurrencies, Cryptoassets, Security Tokens, Utility Tokens, Exchange Tokens, Global Stablecoins, Stablecoins or eMoney Tokens. GlobalStablecoins.com is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

Affiliate Disclosure / Sponsored Posts:

If a Sponsored Post contains any mention of a crypto project, we encourage our readers to conduct diligence prior to taking further action. GlobalStablecoins.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

GlobalStablecoins.com may receive compensation for affiliate links. Should you perform activities in relation to an affiliate link, it is understood that some form of compensation might be made to GlobalStablecoins.com. For example, if you click on an affiliate link, and sign up and trade on an exchange, GlobalStablecoins.com may receive compensation.

Before you invest in Cryptoassets you should be aware of the following,

Cryptoassets are considered very high risk, speculative investments.

If you invest in Cryptoassets you should be prepared to lose all your money.

All Sponsored Posts are paid for by crypto projects, coin foundations, advertising firms, PR firms, or other marketing agencies. GlobalStablecoins.com is not a subsidiary of any marketing agency, nor are we owned by any crypto or blockchain foundation.

The purpose of offering Sponsored Posts to our advertisers is to help fund the day-to-day business operations at GlobalStablecoins.com.

If you come across a Sponsored Post which you believe is fraudulent and/or “scammy,” please contact us and we will perform an immediate investigation.

All Rights Reserved | GlobalStablecoins.com